If You Look At The Performance Of The Zero-income-tax-rate States And The Highest-income-tax-rate States, I Believe A Large Amount Of Their Difference Is Due To Taxes. Not Only Is It True Of The Last Decade, But I Took These Numbers Back 50 Years. And, There's Not One Year In The Last 50 Where The Zero-income-tax-rate States Have Not Outperformed The Highest-income-tax-rate States.

Please Wait....

Translating....

Translating....

If You Look At The Performance Of

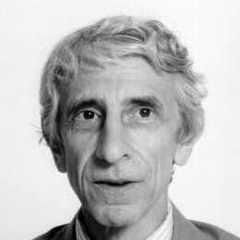

Arthur Laffer

If You Look At The Performance Of The Zero-income-tax-rate States And The Highest-income-tax-rate States, I Believe A Large Amount Of Their Difference Is Due To Taxes. Not Only Is It True Of The Last Decade, But I Took These Numbers Back 50 Years. And, There's Not One Year In The Last 50 Where The Zero-income-tax-rate States Have Not Outperformed The Highest-income-tax-rate States.

Views: 32